Indirect costs are costs that are not directly accountable to a cost object such as particular project, facility, function or product. Indirect costs may be fixed or variable depending on the type and include administration, personnel and security costs. These are the costs which are not directly related to project or production. Some indirect costs may be overhead expenses like rent, gas, electricity and labor burden which are necessary to the continued functioning of business but cannot be immediately associated with the product or services being offered, while some of them can be attributed to project as direct costs.

In Service Industries; to evaluate a project, costs such as rent, office supplies, Information Technology (IT) support, telephone charges and similar costs must be taken into consideration. These costs contribute to keeping the business running. They can be shared among various projects or among different functions or departments and are called indirect costs. Identifying an indirect cost is a prerequisite in calculating the cost of projects and for preparing accurate budget forecasts.

To determine project profitability accurately, some companies include indirect costs associated with the project they work on, in addition to the direct costs that are calculated from employee timesheets. Indirect costs are related to the direct costs from timesheets and are not created or processed on their own. Indirect costs consist of individual elements or components and are typically calculated as a percentage of the direct labor or as an hourly rate. The percentages and rates used for computing indirect cost can be different as compared to the percentages and rates used for computing indirect accrued revenue and billing.

Let me give you an example scenario:

Contoso Consulting USA (USSI) gets into a contract with it’s customer Adventure services to conduct market research on their new video game recently launched into the market, with focus to improve its sales. Both parties agrees to go with the billing based on number of consulting hours spent by the resources on this project assignment and hourly billing rate is $300. The project manager Alex wants to record the indirect cost (Electricity & Office supplies charges) on the project along with direct cost of the resources to measure the project profitability margins accurately.

Now let us set up this in AX2012 by following below steps:

Pre-requisite:

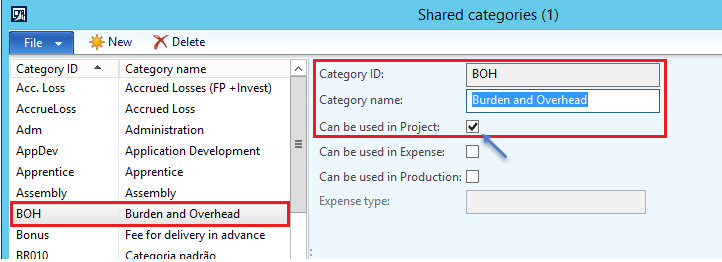

- We need to create an indirect project category to map with indirect cost components as they can’t be directly expensed on the project. To do this, navigate to Project management and accounting=> Setup=> Categories=> Shared categories

- Create a new shared category and enable Can be used in Project check-box, to be able to use in project categories form.

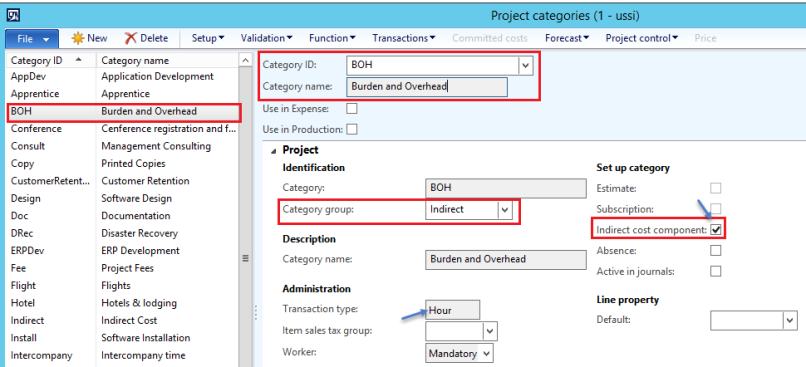

- Navigate to PMA=> Setup=> Categories=> Project categories, create new project category and select Category group of transaction type Hour.

- Mark the Indirect cost component check-box to setup this project category for indirect costs and hence it can’t be selected in project timesheet directly to expense.

Scenario steps:

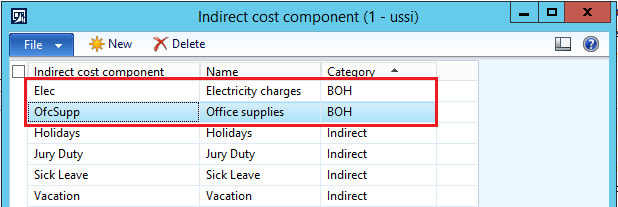

- Navigate to Project management and accounting=> Setup=> Indirect cost component=> Indirect cost component

- Create indirect cost components Electricity & Office supplies as per our requirement and associate them with our project category created earlier.

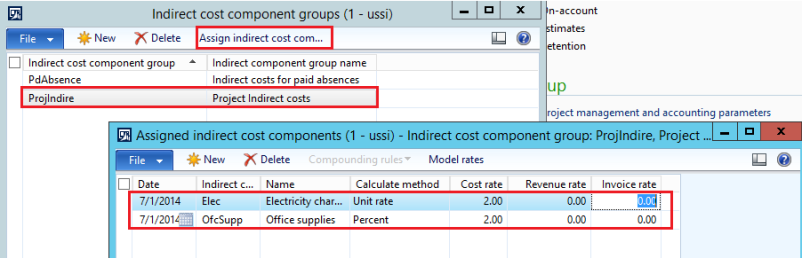

- Navigate to PMA=> Setup=> Indirect cost component=> Indirect cost component group

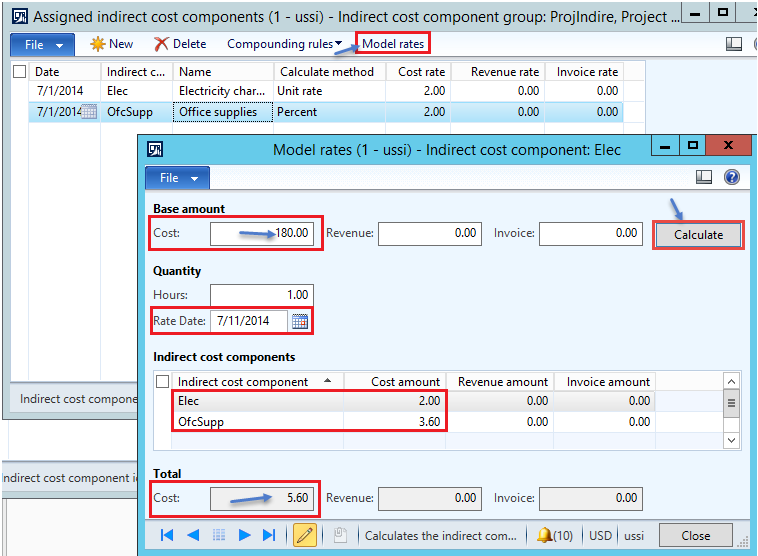

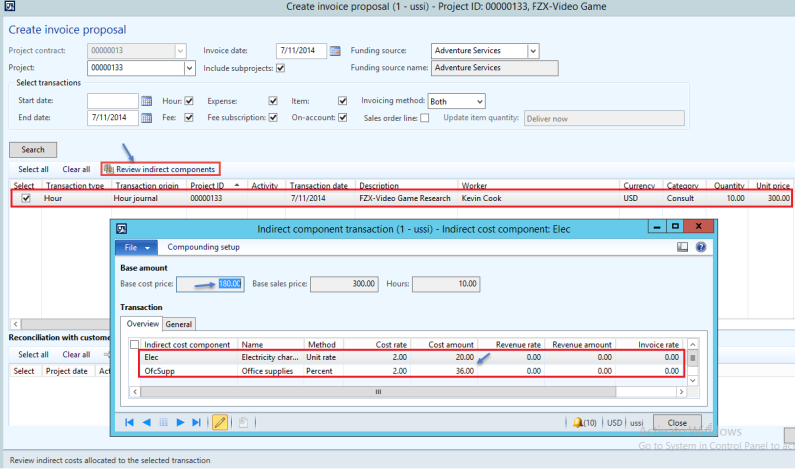

- Create an indirect cost component group to specify these indirect cost components and define the model rates. In our case we have taken electricity as 2$/hour unit rate and office supplies consumption as 2% of the consulting cost.

Note: These rates varies from company to company and depend on the type to which organization wants to calculate indirect cost. As in our example Alex wants to calculate additional cost on project but he can’t invoice the customer for this cost; therefore, the accrued revenue and invoice rates would be zero. But we can also associate these rates and bill to customer if applicable.

- When defining the percent calculation method we need to specify the base for calculation. To do this click on Compounding rules=> Cost for the Office supplies indirect cost component line and include the Base amount component into Selected indirect cost components list.

- Now click on Model rates button to view the indirect cost calculations. Specify the consulting cost which is $180/hour in our case and click on Calculate button to see what would be the hourly indirect cost amount for these cost components.

- Now create a time and material project against the contract with Adventure services and specify the project details.

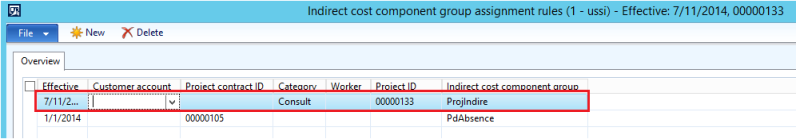

- To associate indirect costs with this project, navigate to PMA=> Setup=> Indirect cost component=> Indirect cost component group assignment rules.

- Specify the criteria like Effective date, Category on which indirect cost needs to be computed, Project to be considered and finally indirect cost component group as shown below.

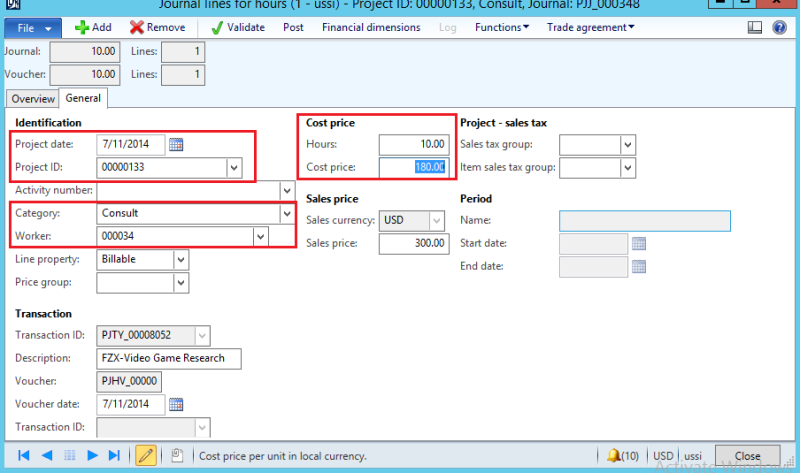

- Once the project starts, Kelly (the project accountant) changes project status to In progress and starts recording efforts on the project. She records 10 hours being spent on the consultation by one of the worker.

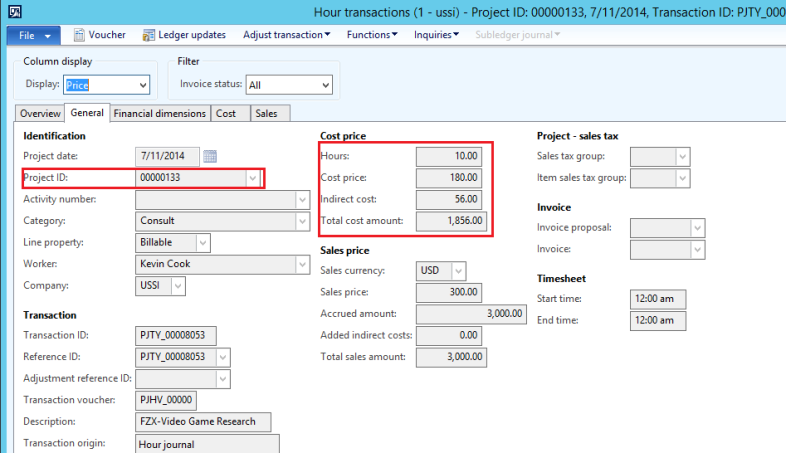

- To do this through hour journal, click on Hour button from project details form and click on Create new button or New=> Lines button. In the opened journal lines, set details like Project date, Project ID, Category, Worker and No.of hours spent by the worker. Define cost price $180/hourand sales price $300/hour as per the contract terms.

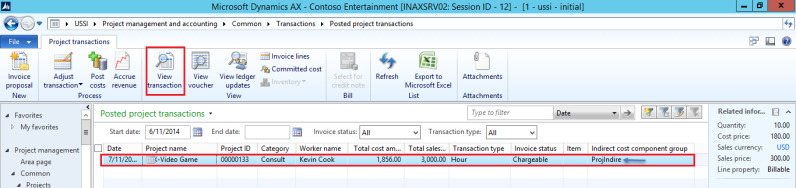

- Post the journal entry and check the Posted project transactions from Manage tab of the project details form.

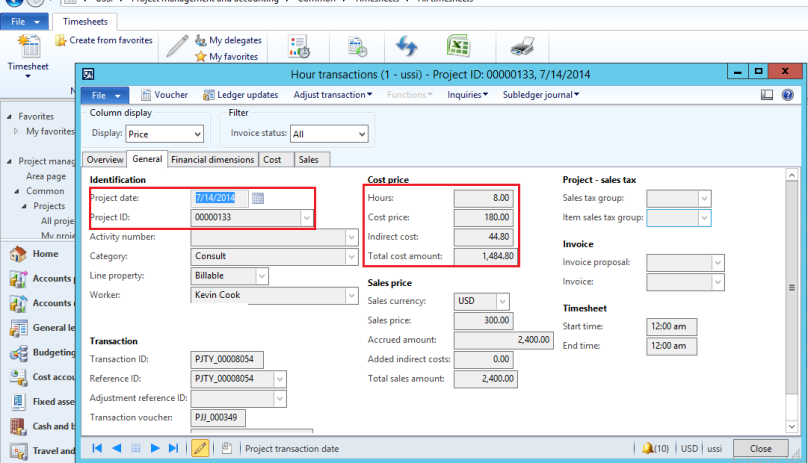

- Observe that indirect cost component group is triggered on the transaction as it matched with the assignment rules that we had defined. Click on View transaction to check calculated indirect cost amount on the transaction.

- We can see that indirect cost amount is calculated as per the model rate setup and included in the total cost amount of the transaction.

Calculation:

| Indirect Cost Component | Calculation Method | Cost Price/Hour | Indirect Cost Amount/Hour | Total Hours | Total Indirect Cost |

| Electricity | Unit rate: $2 | $180.00 | $2.00 | 10 | $20.00 |

| Office supplies | Percentage: 2% | $180.00 | $3.6 (2% of cost price $180.00) | 10 | $36.00 |

Total indirect cost= Electricity $20.00 + Office supplies $36.00= $56.00

Total cost amount=$180.00 (cost price)*10 (Total hours)+$56.00 (total indirect cost)= $1856.00

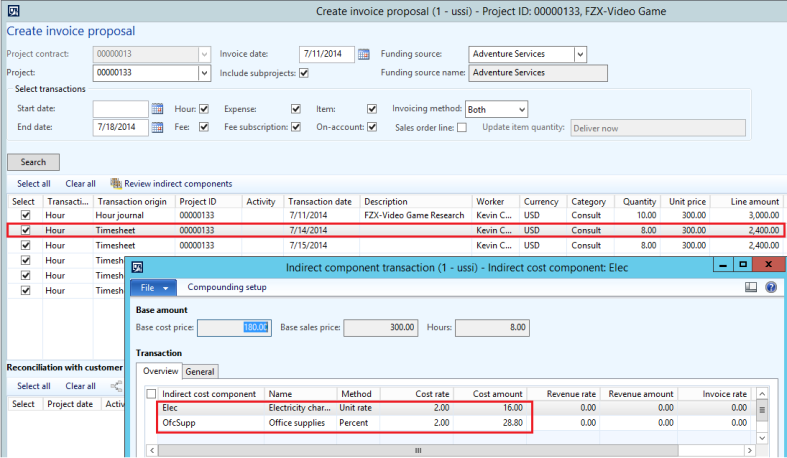

- Now Alex wants to bill this to customer. He can review the indirect cost amounts on the Create invoice proposal form before he could raise a customer invoice. The indirect cost amounts are displayed perfectly!!!

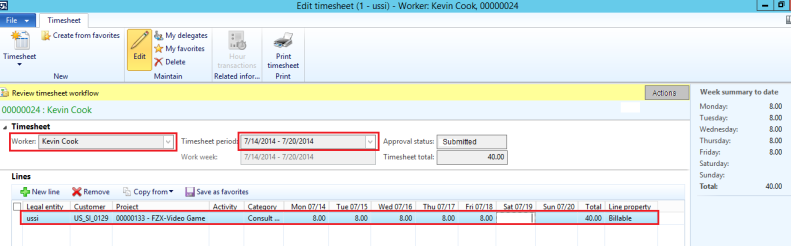

- For the next week, consultant Kevin cook works at the customer site and records the effort spent on the project consulting through timesheet using enterprise portal. He further submits the timesheet for his manager Alex’s approval.

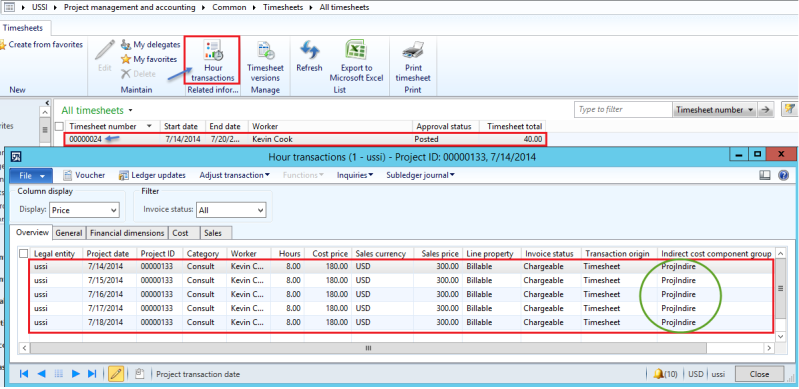

- Alex opens the timesheet and checks the details. He finds that Kevin has worked for 40 hourson the project assignment and all other details are entered correctly. He then approves it!

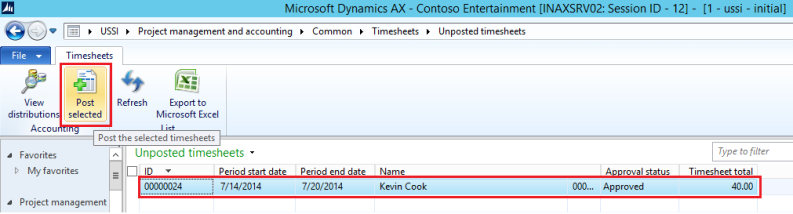

- Kelly finds the approved timesheet from PMA=> Common=>Timesheet=> Unposted timesheetsand posts it.

- View the hour transactions generated from posted timesheet. Observe that indirect cost component group is triggered as the criteria matched with assignment rules that we had defined.

- Also the indirect cost amounts are computed based on the model rate calculations. Awesome!!! Isn’t it?

- Now while creating invoice proposal for the next week Kevin reviews the indirect cost amounts and finds that they are computed correctly as per defined model rates.

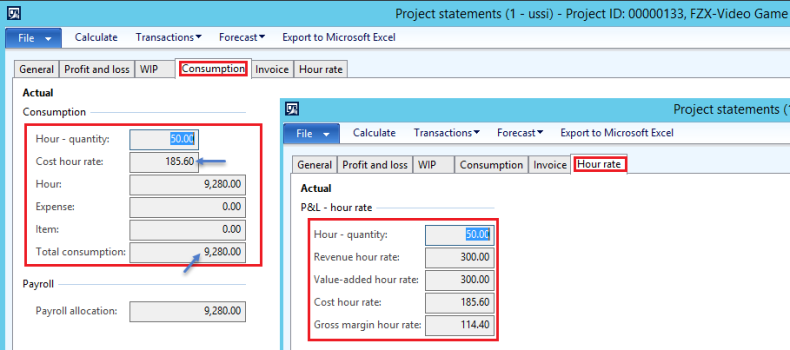

- View the project statements for hourly rate and cost consumption details. They are displayed with indirect cost amounts included. [To do this, click on Project statement button on Control tab of project details form.]

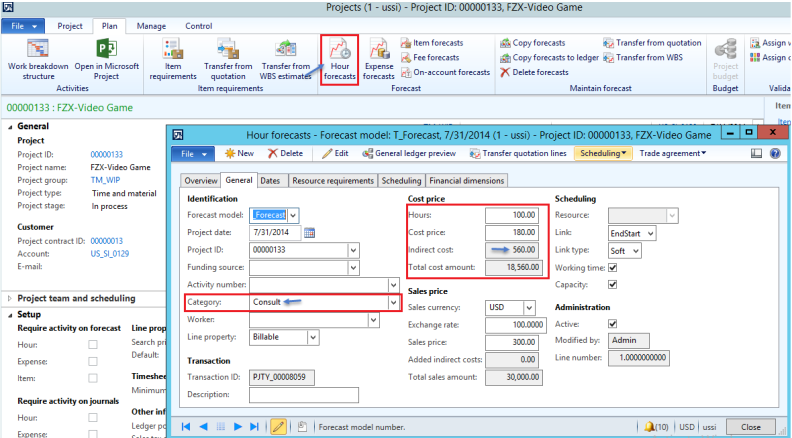

- Alex (the project manager) forecasts resource effort for the whole month and observes that indirect cost is calculated and included in the total cost amount for the hour forecast as criteria matched with indirect cost component group association rules.

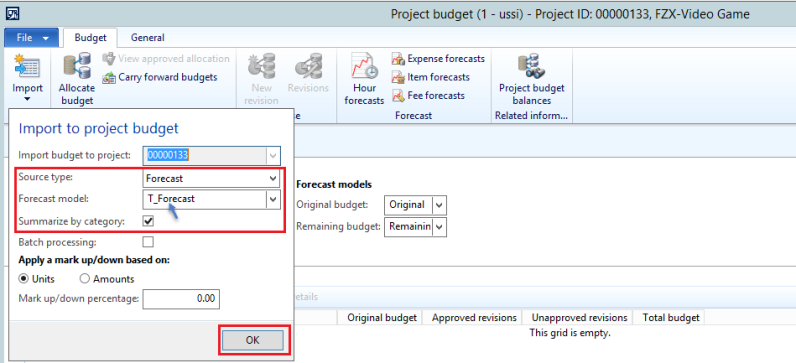

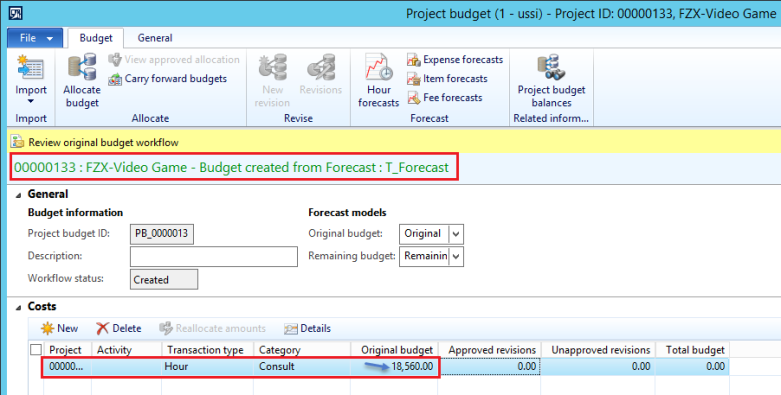

- Also while he creates the project budget using this forecast to control the costs on project, he observes that the budget amount includes the indirect cost as well!!

Note: You can see this Import function only in the newer versions of AX2012. In older versions, use Budget source field to select Forecast option and enter appropriate forecast model to import the details from.

No comments:

Post a Comment