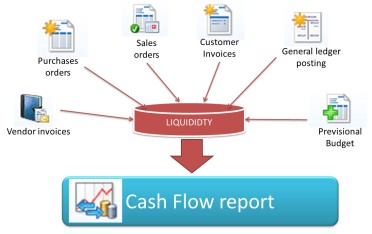

The objectives of this article are to explain the relationship between cash flow and other modules in Dynamcis AX 2012 and how to setting forecast cash flows.

Cash flow is the movement of money into or out of a business (Incomings and outgoings of cash). It is usually measured during a specified, limited period of time. In Dynamics AX, you can use the tools of cash flow forecasts and currency requirements to estimate future availability needs for the company.

For the cash flow forecasts are reliable, functionality must:

- Identify and list all liquidity accounts, which are cash accounts (or equivalent) of the company;

- Identify and configure the forecast transactions that affect liquidity accounts of the company;

- Monitor the level of integration of forecast cash flow selecting parameters for forecasts cash flow;

- Calculate and display forecasts of cash flows;

- Analyze cash flows with a statement of cash flows created by using the financial statement functionality.

Relationship between cash flow and other modules:

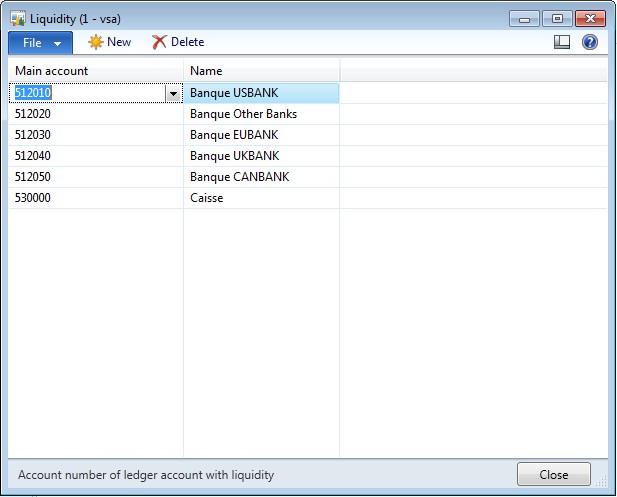

1/ Liquidity accounts

Access : GL > Setup > Posting > Liquidity

Setup all liquidity accounts used for caching cash receipt or cash disbursements: bank accounts, cash accounts, ….

- Click on “New”

- Select the main account

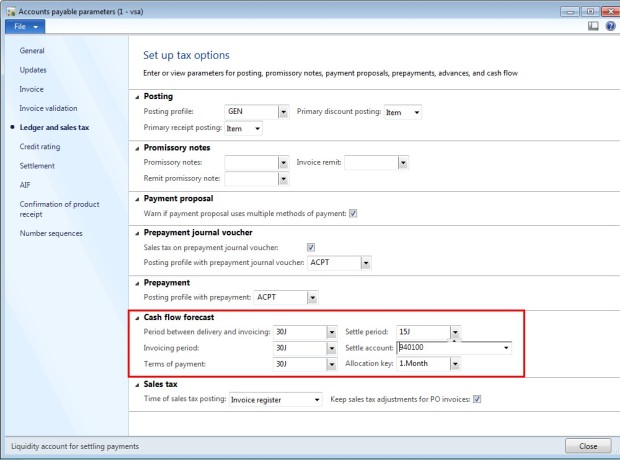

2/ Accounts payable parameters

Access : AP > Setup > AP Parameters > Ledger and Sales tax tab

Set up default values to use on vendors transactions affecting the cash flow.

- Period between delivery and invoicing: select a value that represents the interval between the purchase order delivery date and the expected invoicing of the order.

- Invoicing period: select a value that represents the interval between future purchases transactions and the invoice date

- Terms of payment: select default terms of payment for purchases. This value is used for cash flow calculations except when the terms of payment are specified on the purchase order.

- Settle period: select the value that represents the expected delay between the due date and the date of payment.

- Settle account: select the liquidity account that is the default account to which vendor payments are posted.

- Allocation key: select the value that reduces the effect of the budget in the cash flow forecast as purhase orders are created.

Remark: if the value you need is not available, go to AP > Setup > Payment > Terms of payment to create a new one (or click directly on “View details” when you are in the field).

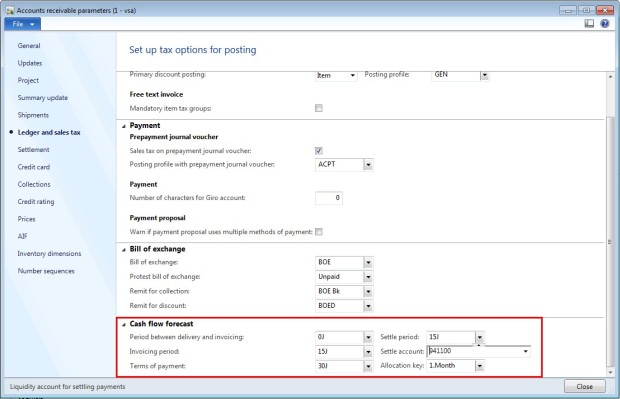

3/ Accounts receivable parameters

Access : AR > Setup > AR Parameters > Ledger and Sales tax tab

Set up default values to use on customers transactions affecting the cash flow.

- Period between delivery and invoicing: select a value that represents the interval between the sales order delivery date and the expected invoicing of the order.

- Invoicing period: select a value that represents the interval between future sales transactions and the invoice date

- Terms of payment: select default terms of payment for sales. This value is used for cash flow calculations except when the terms of payment are specified on the sales order.

- Settle period: select the value that represents the expected delay between the due date and the date of payment.

- Settle account: select the liquidity account that is the default account to which customers payments are posted.

- Allocation key: select the value that reduces the effect of the budget in the cash flow forecast as sales orders are created.

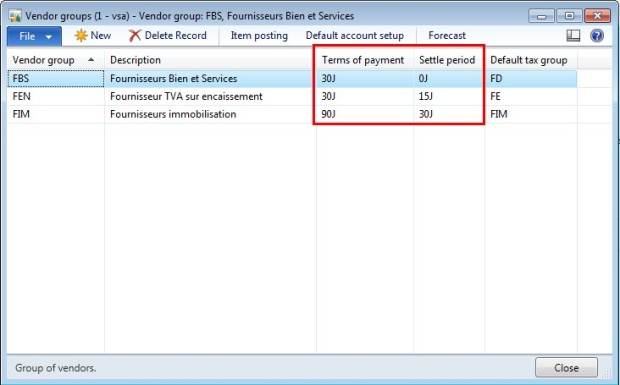

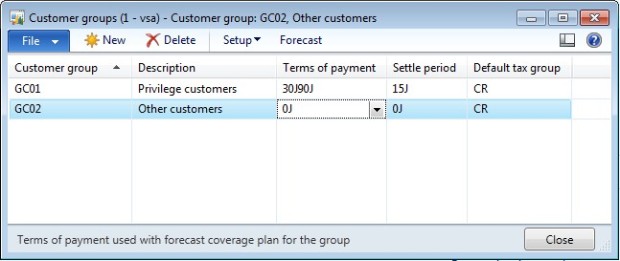

4/ Vendor and Customer groups

Access : AP/AR > Setup > Customer/Vendor > Customer/Vendor group

For the terms of payment and the settle period, it is possible to set up a more specific value for each groups.

- Vendor groups

- Customer groups

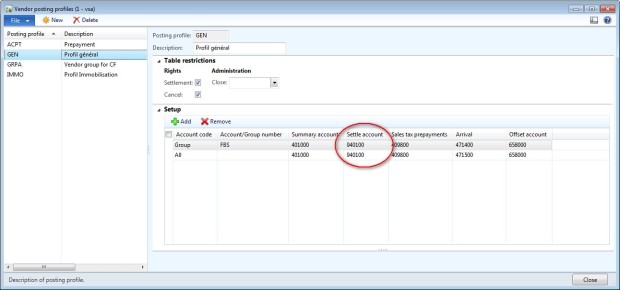

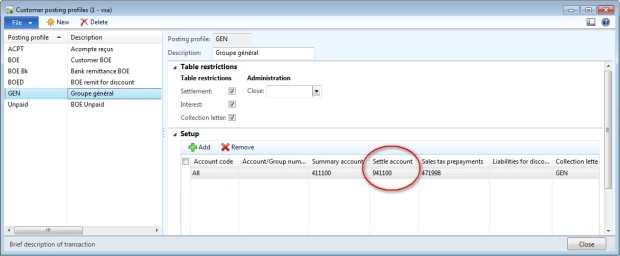

5/ Vendor and Customer posting profiles

Access : AR/AP > Setup > Vendor/Customer posting profiles

For each customer/vendor posting profile, you can select a Settlement account. This account will be used in the financial statement.

- Vendor posting profile

- Customer posting profile

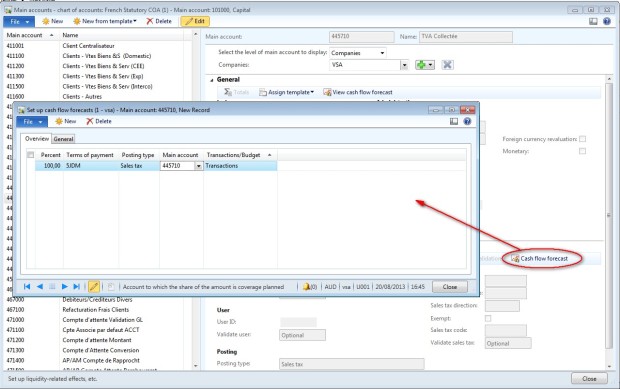

6/ General ledger accounts

Access : GL > Setup > Chart of accounts > Chart of accounts or Common > Main accounts

Some cash flow transactions are not recorded in a purchase order or in an invoice. It is the case for the payment of taxes for example. So you can setup some general ledger accounts to be used in the cash flow forecast.

- Edit the main account.

- Check the level of main account selected is “Companies”.

- Click on “Cash flow forecast” button.

- Select a percent to apply, termos of payment and the main account.

It is also possible to set up a dependent cash flow forecast for a main account that contains transactions that are directly related to transactions in another main account : for more details go to : technet microsoft.

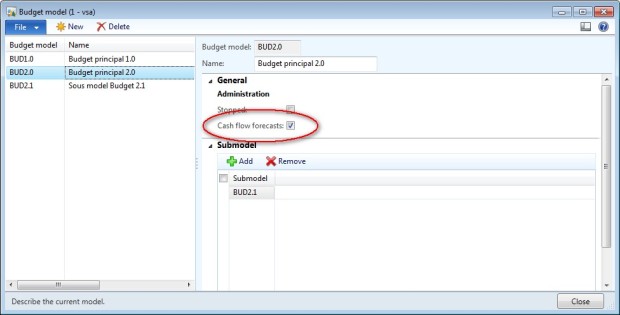

7/ Budget models

Access : Budgeting > Setup > Budgets models

You can include budgets that are created from budget models in cash flow forecasts : If you want the cash flow forecast to include budgets that are based on a specific budget model, select the Cash flow forecasts check box.

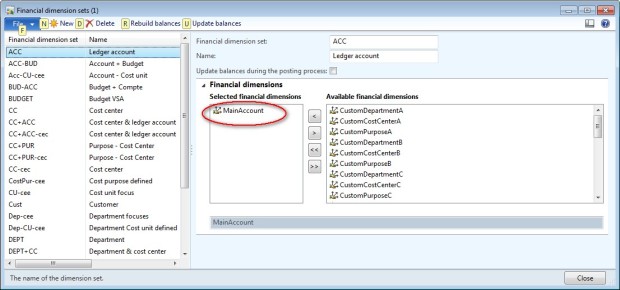

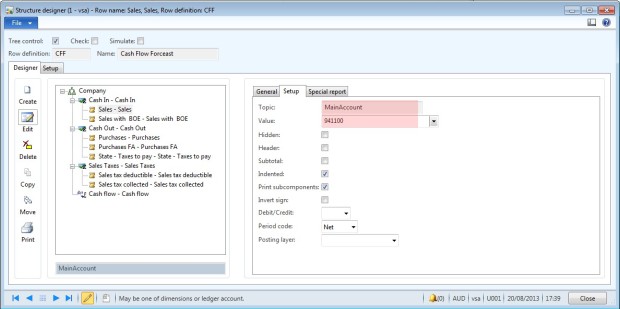

8/ Create a cash flow statement

The last step of the setup is to create a financial statement for the analysis of the cash flow forecast. For more details about the creation of a financial statement, go to this article : Financial statement general setup.

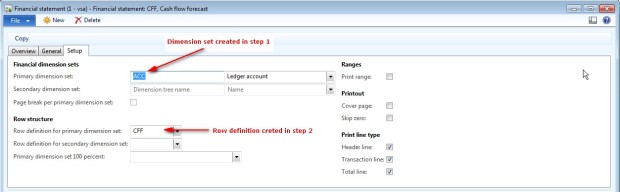

- Step 1: Create a financial dimension step with the main accounts : GL > Setup > Financial dimension > Financial dimension set

- Step 2: Create a row definition with a structure designer that contains all the settle accounts from customer/vendors posting profiles, general accounts with cash flow forecast, and accounts used in budget with forecast. (GL > Setup > Financial statement > Row definition)

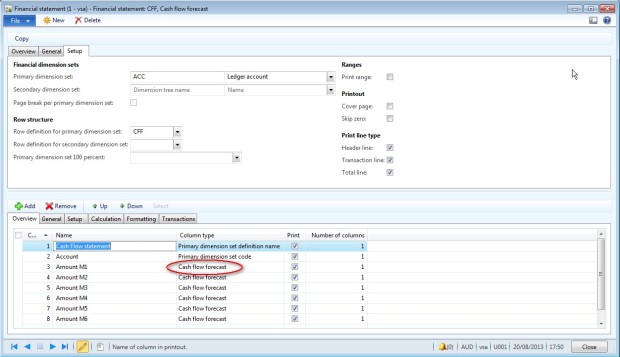

- Step 3: Create a new financial statlement: GL > Setup > Financial statement > Financial Statement

- Step 4: create the column for the cash flow report. (GL > Setup > Financial statement > Financial Statement). Select “Cash flow forecast” to display the cash flow amount.

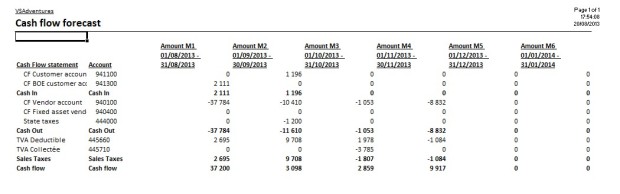

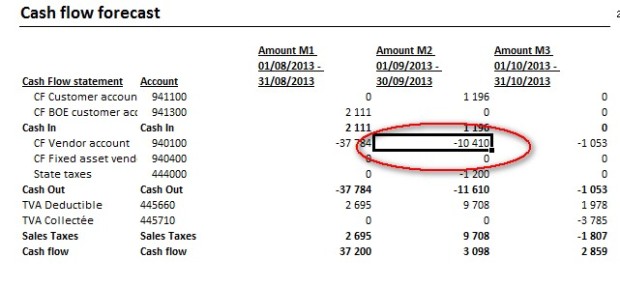

- Example of statement:

9/ Cash flow calculation

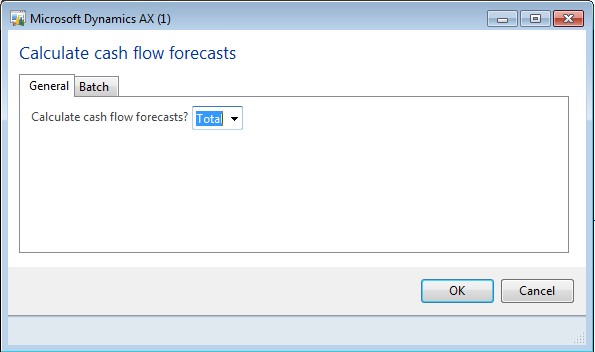

Access : GL > Periodic > Currency requirement > Calculate cash flow forecast

To be able to see cash flow forecast, you must run the “Calculate cash flow forecast” batch.

Select which kind of forecast calculation to perform:

- Total: Clear all cash flow forecast transactions and recalculate. This option is preferred if you have not updated the cash flow forecasts for a long time.

- New: Create a new cash flow forecast, but do not clear other cash flow forecasts. This option lets you investigate, for example, the consequences of budget modifications.

10/ Example of cash flow transaction

- Vendor account cash flow forecast for period 01/09/2013 to 30/09/2013 = 10 410

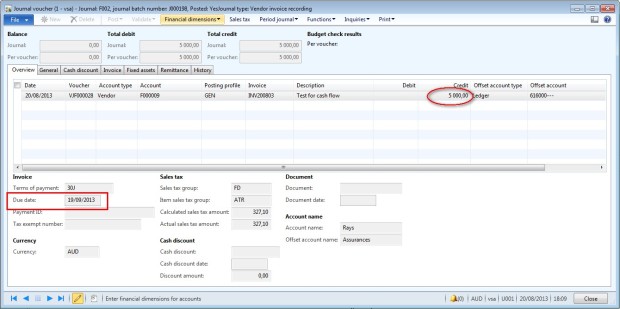

- New vendor invoice : $5000 / Due date = 19/09/2013

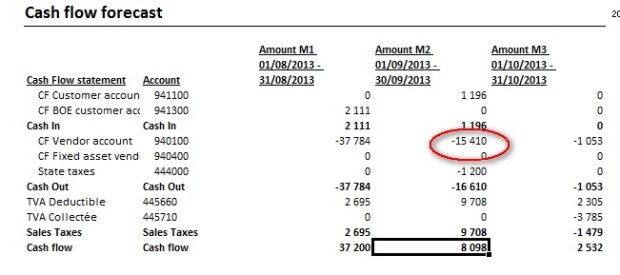

- Generating “Calculate cash flow forecast”

- Display the cash flow report : Vendor transaction cash flow forecast for period 01/09/2013 to 30/09/2013 = 10 410 + 5 000

Nice article!! Thanks for sharing amazing article I was also searching for Cash Flow Management. and your article really helps me a lot.

ReplyDeleteCash flow management is a very important aspect on every businesses. It determines which money goes in and goes out from the business. Measuring such things would really help a business avoid losses and of course bankruptcy.

ReplyDeleteEffective cash flow management requires a proactive and strategic approach. By implementing these principles, businesses and individuals can enhance their financial resilience, maintain liquidity, and position themselves for long-term success.

ReplyDeleteMoolamore is an advanced accounting application that analyzes, manages, and projects real-time transaction data. Using our cash flow forecasting software and app, you can forecast and estimate your company's future financial position. Financial Management