Sales tax setup

This article describes how to setup sales tax in Dynamics AX2012

1/ Introduction

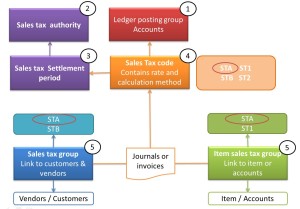

In Dynamics AX, there are several elements to create for the sales tax functionality:

- Ledger posting group: this element contains all ledger accounts.

- Sales tax code: this element contains the sale tax rate and the calculation method (rounding).

- Sales tax group: this element is the link between the sales tax code and customer/vendor.

- Item sales tax group: this element is the link between the sales tax code and the item.

- Sales tax settlement period: this element contains the period of payment of the sales tax.

- Sales tax authority: this element is linked to the settlement period. It can be linked to a vendor to automize the payment.

To setup the sales tax, you must follow the order below:

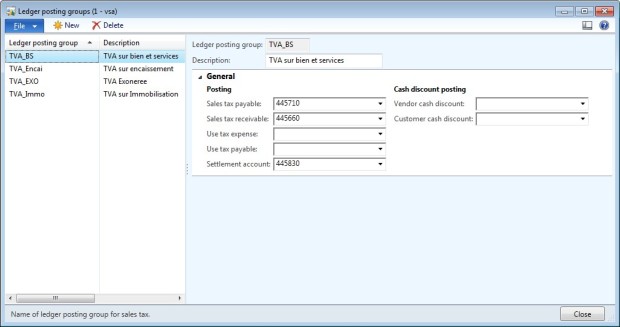

2/ Step 1: Ledger posting group

Access: General Ledger > Setup > Sales tax > Ledger posting groups

- Click new to create a new ledger posting group.

- In the field “ledger posting group”: enter a unique code.

- In the field “description”: enter a description.

- On the General tab, enter the ledger account to use.

Description of the accounts:

- Sales tax payable: account use in a customer invoice. It is the sale tax to pay at the authority.

- Sales tax recevable: account use in a vendor invoice. it is the tax deductible.

- Use tax expense: account use when the sales tax is due on a payment and not on the customer invoice.

- Use tax payable: account use when the sales tax is due on a payment and not on the vendor invoice.

- Settlement account: account use for the payment of the tax.

- Vendor cash discount: account number of cash discount payable.

- Customer cash discount: account number of cash discount granted.

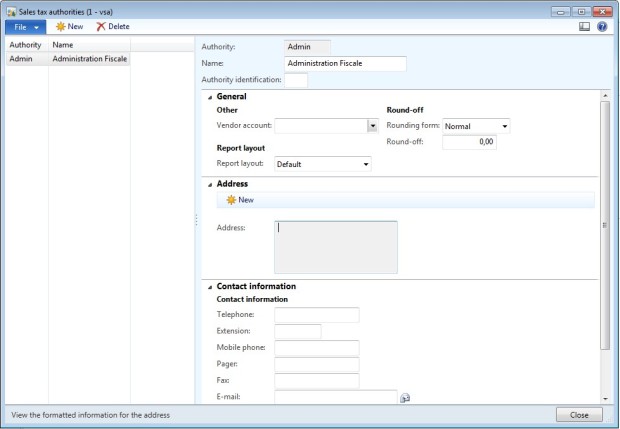

3/ Step 2: Sales tax authority

Access: General Ledger > Setup > Sales tax > Sales tax authorities

- Click new to create a new sales tax authority. You must created one at least.

- Enter a code in the “Authority” field

- Enter a name/description in the “Name” field.

- You can link the authority to a vendor account.

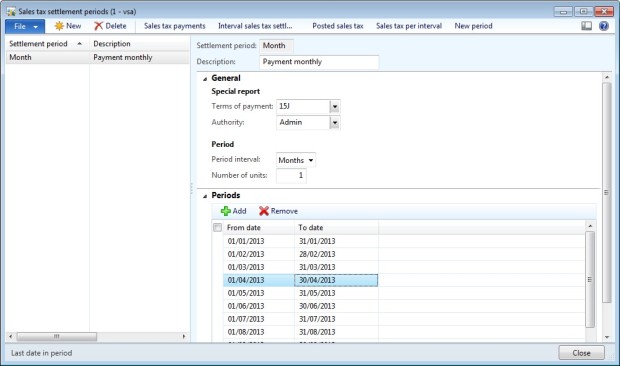

4/ Step 3: Sales tax settlement period

Access: General Ledger > Setup > Sales tax > Sales tax settlement periods

- Click new to create a new sales tax settlement period.

- Enter a code in the “Settlement period” field

- Enter a description

- Select a Terms of payment (link to the AP>Setup>Payment>Terms of payment screen)

- Select the authority created in the preceding step.

- Choose you period interval and the number of units: Months/1 for a monthly payment, Months/3 for a payment every quarter…

- Create the first single period (select from date and to date) and click on “New period” button in the top of the screen to create the next periods.

Remark : add the last step in the task list of the end of year to create all the single periods of the new year.

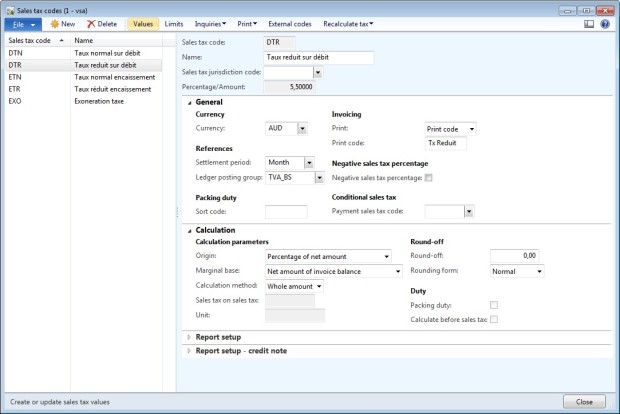

5/ Step 4: Sales tax codes

Access: General Ledger > Setup > Sales tax > Sales tax codes

- Click on New to create a new sales tax code

- Enter the sales tax codes (choose a short one if you want to print it in the statement).

- Enter the full name in the “Name” field.

- Select the settlement period (created in step 3).

- Select the ledger posting group for this code (created in step 1).

- Select ohter option: currency, print code, calculations parameters, …

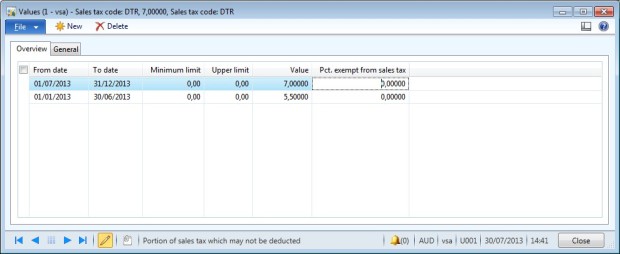

- Click on “Values” to add a rate.

- You don’t need to enter dates for the first rate (if there is only one rate).

- You can enter a rate by amount range, and choose the option “interval” in the calculation method.

Remarks:

- If the rate of a sales tax change, you don’t have to create a new code, but just add a new rate in the value screen with the start date, and add an end date to the old rate.

- When you create a sales tax code, don’t put the rate in the name, because the rate can change.

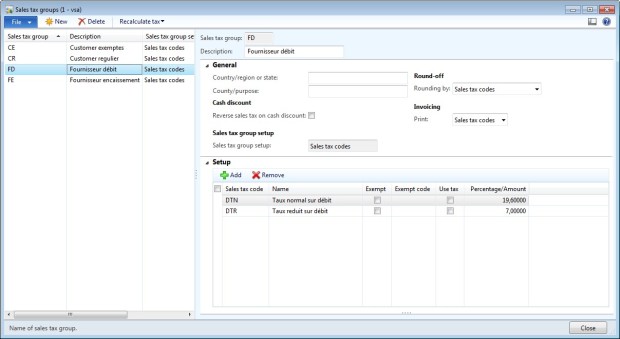

6/ Step 5: Sales tax group

Access: General Ledger > Setup > Sales tax > Sales tax groups

To identify the number of group you need, look for the criteria of the application of the sales tax related to the customer or the vendor. Example: national or international customer, vendor with VAT on invoice or VAT on cash receipt, vendor of goods or fixed assets vendor, …

- Click New to create a new sales tax group.

- Enter the code of the sales tax group.

- Enter a description.

- In the tab “Setup” add all the sales tax codes than can be suitable for the sales tax group.

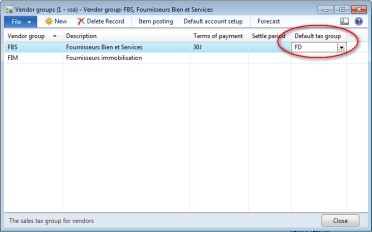

- The sales tax group will be link to the vendor/customer by the vendor/customer group or directly on the vendor/customer screen.

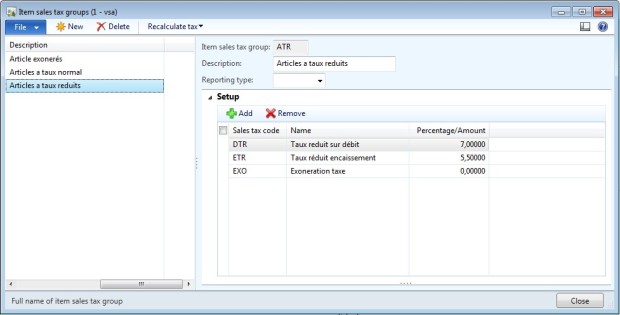

7/ Step 6: Item sales tax group

Access: General Ledger > Setup > Sales tax > Item sales tax groups

To identify the number of group you need, look for the criteria of the application of the sales tax related to the items. Example: item with normal rate or with reduced rate, exempted item, …

- Click New to create a new item sales tax group

- Enter a code to the item sales tax group.

- Enter a description.

- In the tab “Setup” add all the sales tax codes than can be suitable for the item sales tax group.

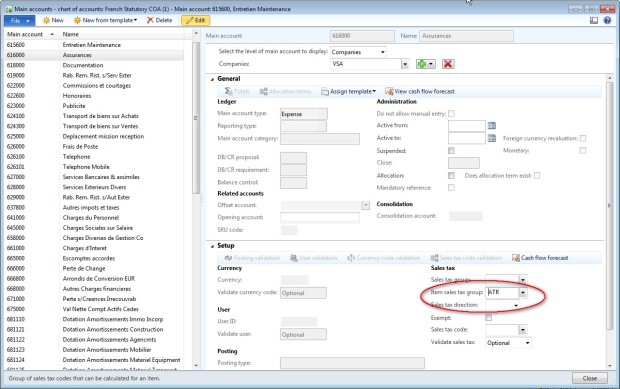

- The item sales tax group can be linked to the item or to a general account (if the account is setup at the company level).

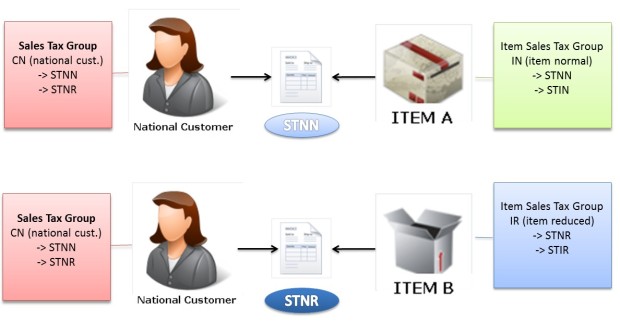

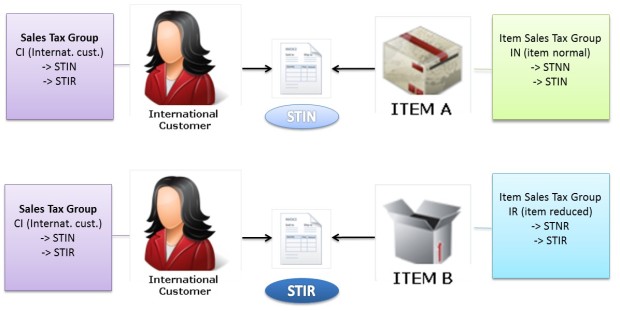

8/ Example for customer invoices

The ABC company need 4 sales tax codes for the customer invoices:

- Sales tax with normal rate for national customer (code STNN)

- Sales tax with normal rate for international customer (code STIN)

- Sales tax with reduced rate for national customer (code STNR)

- Sales tax with reduced rate for international customer (code STIR)

We need to create 2 sales tax groups :

- One group for the national customers (code CN): with the sales tax codes STNN & STNR

- One group for the international customers (code CI): with the sales tax codes STIN & STIR

We need to create 2 item sales tax groups:

- One for the normal rate (code IN): with the sales tax codes STNN $ STIN

- One for the reduced rate (code IR): with the sales tax codes STNR & STIR

Sales tax code deduced from a sale to a national customer:

Sales tax code deduced from a sale to an international customer:

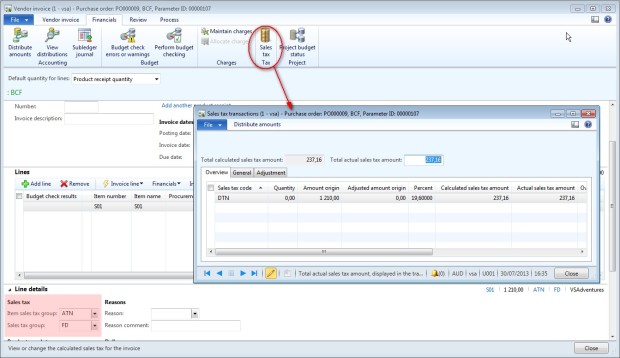

9/ Example in a vendor invoice

Access: Accounts payable > Common > Purchase order > All purchase orders > Invoice

Halo,I'm Helena Julio from Ecuador,I want to talk good about Le_Meridian Funding Service on this topic.Le_Meridian Funding Service gives me financial support when all bank in my city turned down my request to grant me a loan of 500,000.00 USD, I tried all i could to get a loan from my banks here in Ecuador but they all turned me down because my credit was low but with god grace I came to know about Le_Meridian so I decided to give a try to apply for the loan. with God willing they grant me loan of 500,000.00 USD the loan request that my banks here in Ecuador has turned me down for, it was really awesome doing business with them and my business is going well now. Here is Le_Meridian Funding Investment Email/WhatsApp Contact if you wish to apply loan from them.Email:lfdsloans@lemeridianfds.com / lfdsloans@outlook.comWhatsApp Contact:+1-989-394-3740.

ReplyDelete